TPC Updates Analysis of Ted Cruz's Tax Proposal To Reflect a Change in His EITC Proposal | Tax Policy Center

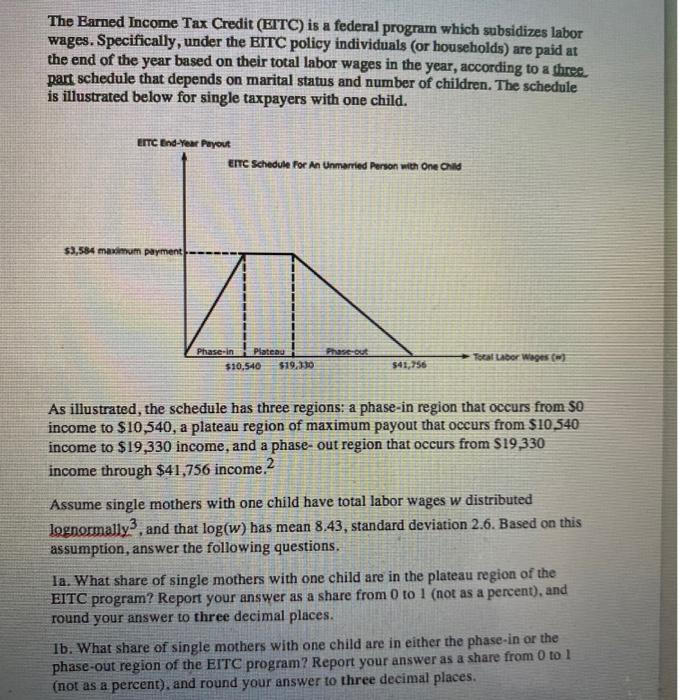

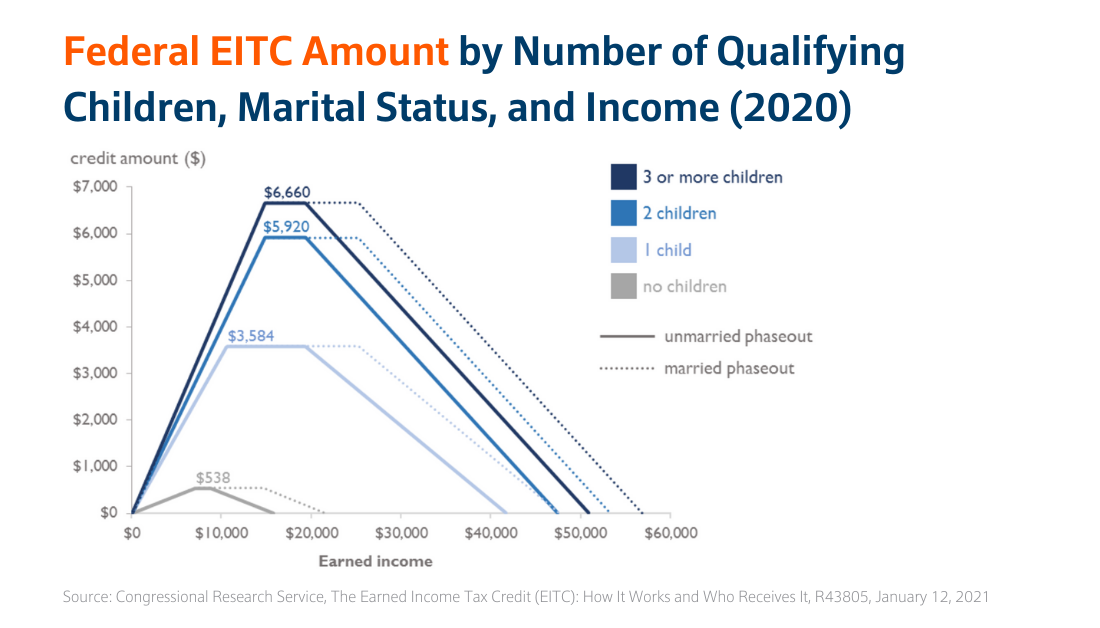

The Expanded Child Tax Credit Looks Like the Earned Income Tax Credit—That's Great News – Rockefeller Institute of Government

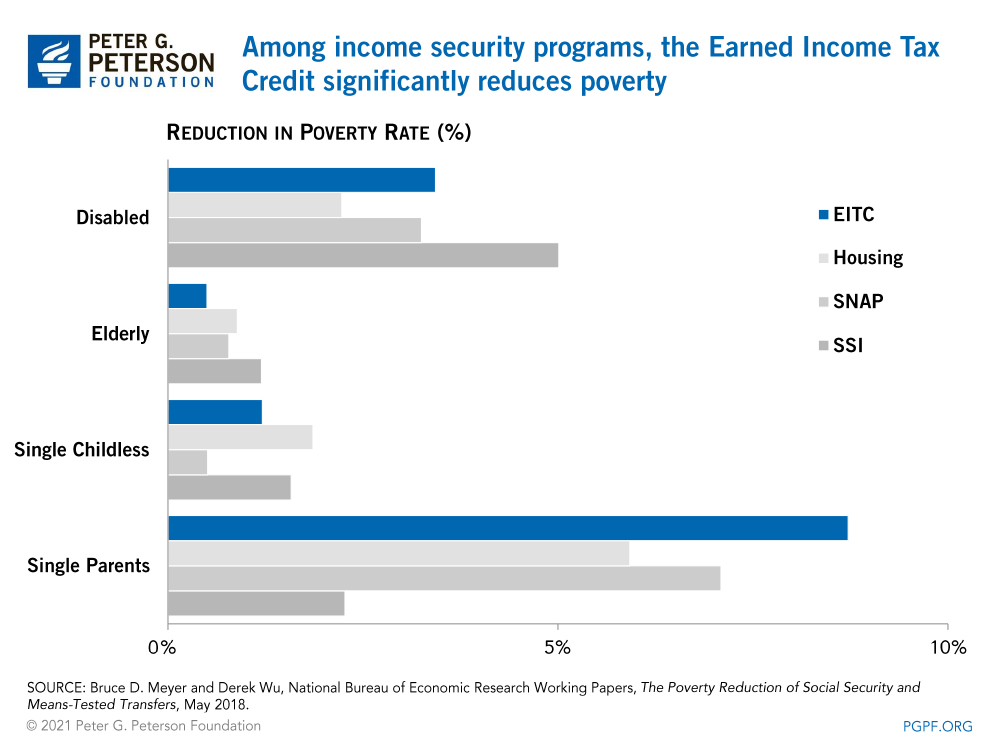

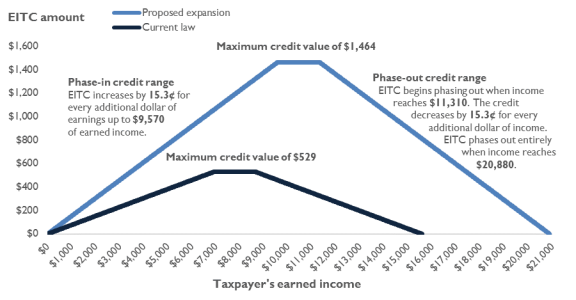

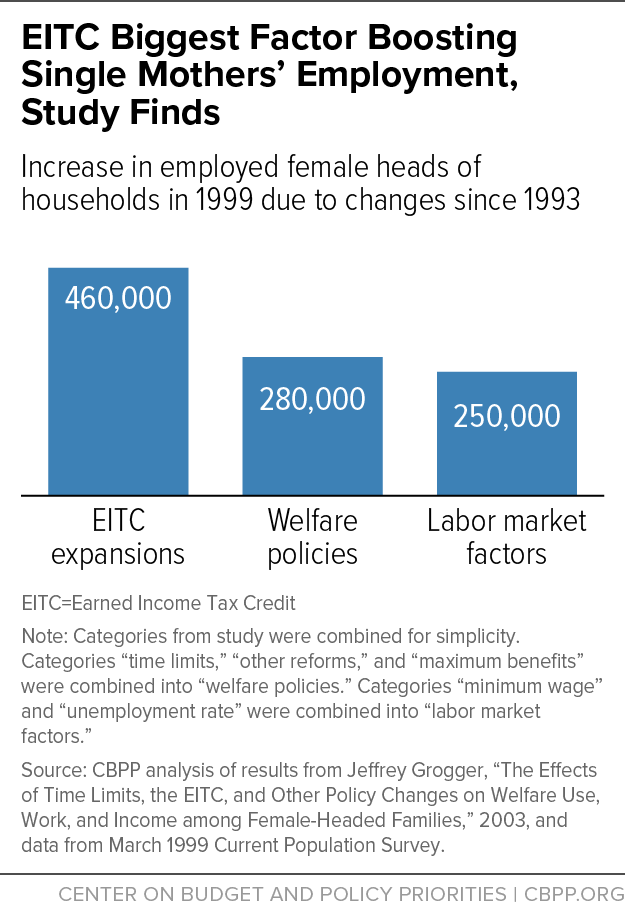

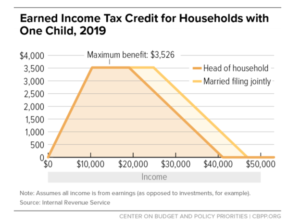

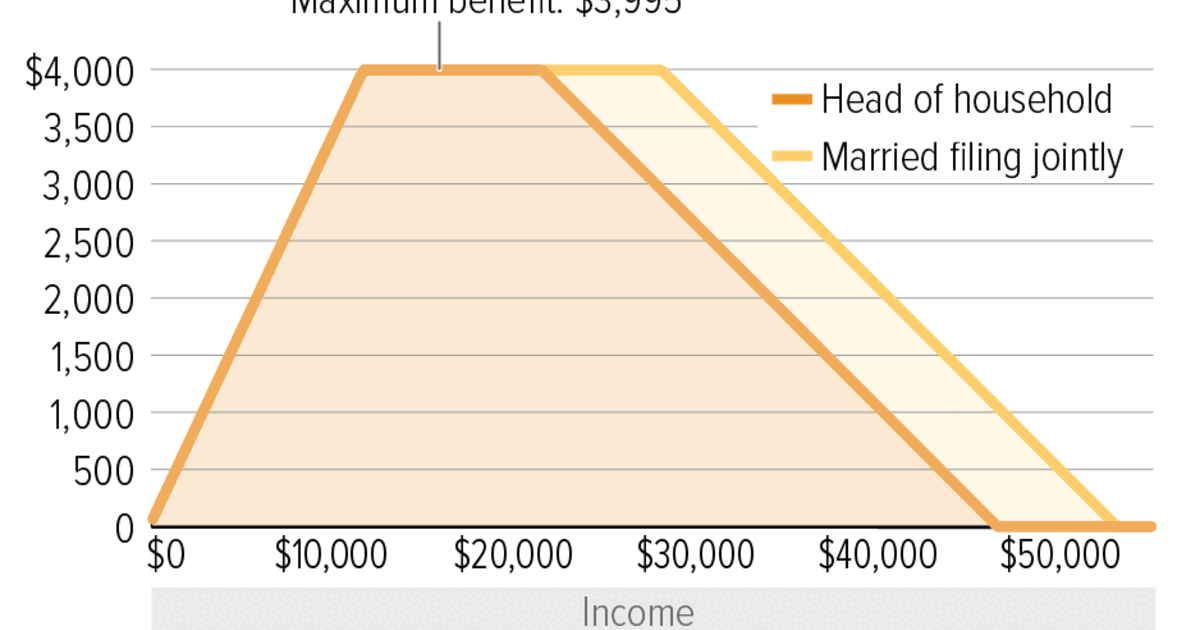

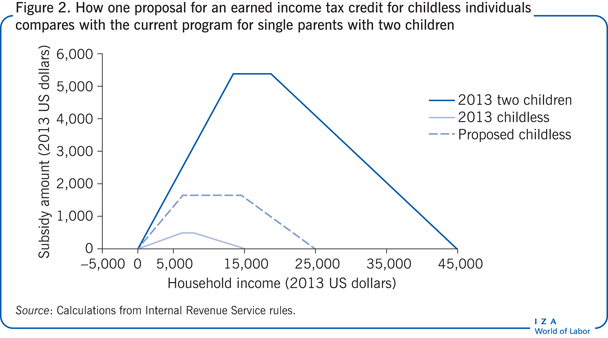

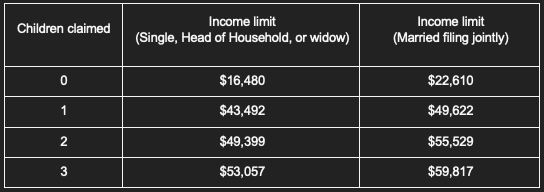

Strengthening the EITC for Childless Workers Would Promote Work and Reduce Poverty | Center on Budget and Policy Priorities

/do0bihdskp9dy.cloudfront.net/02-14-2023/t_acc3b8a6890a49428a3a980bdc20b1b5_name_file_1280x720_2000_v3_1_.jpg)